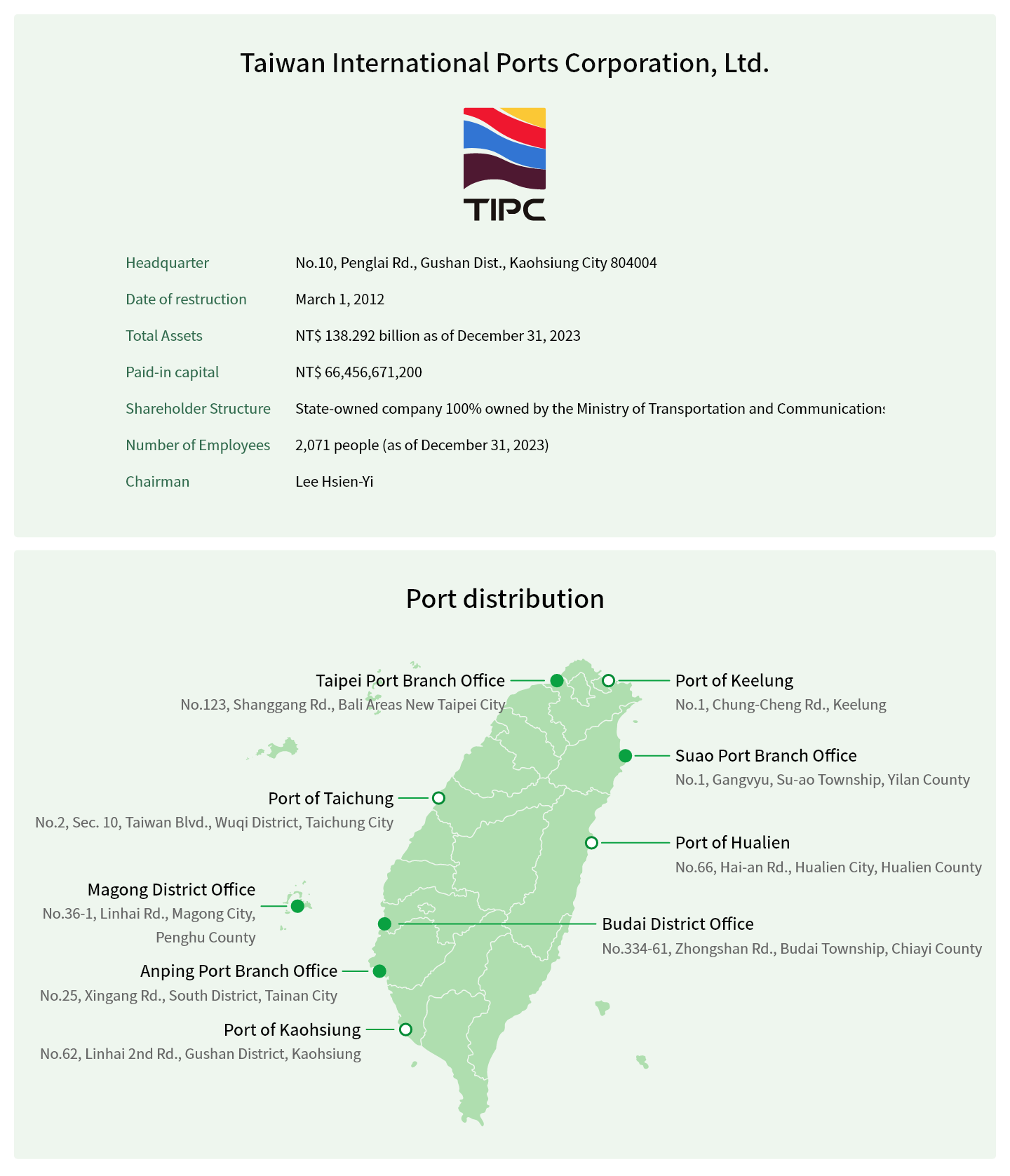

The administration and management of ports in Taiwan were originally combined, in which there were four harbor bureaus, including Keelung Harbor Bureau, Taichung Harbor Bureau, Kaohsiung Harbor Bureau, and Hualien Harbor Bureau under the Ministry of Transportation and Communications. In March 2012, in order to enhance the competitiveness of the port, and in line with the government's organizational reengineering process and the introduction of entrepreneurship into the operation of the port, the Maritime Port Bureau, MOTC was established to handle public affairs of shipping and port administration. Under the direction of "corporatization", the four harbor bureaus were transformed into the Taiwan International Port Corporation (TIPC). TIPC specializes in port operations to enhance the efficiency and flexibility of port operations, promote the development of port area, and drive the economic prosperity of regional industries.

According to TIPC's development strategy and goals, we mainly focus on existing port core services. Additionally, in line with international port operation trends, we are expanding into asset development, equity investment, and internationalization to explore business diversification.

TIPC continued to manage each equity investment plan and business in accordance with the relevant government and TIPC's regulations and bylaws. As of the end of 2023, TIPC held more than 20% shares of the equity in a total of 7 equity investment businesses.

2014

Established on October 9, 2014, with a paid-in capital of NT$ 300 million. TIPC owns 40% shares. It TIPL operates logistics warehousing business in Kaohsiung Port, Taichung Port and Taipei Port.

Established on October 16, 2014, with a paid-in capital of NT$ 3.941 billion. TIPC owns 100% shares. TIPM’s main business services are main business services are marine transportation related services in the commercial port area, such as vessel entry departure and berthing operations, and a ship repair facility to provide high-quality ship repair services.

2017

Established on March 29, 2017, with a paid-in capital of NT$ 100 million. TIPC owns 51% shares. KPLD’s main business is to promote the development of the old port area and the surrounding areas of Kaohsiung Port by combining the resources and platforms of TIPC and Kaohsiung City Government to achieve the goals and benefits of regional development.

2018

Established on May 15, 2018 with a paid-in capital of USD 1.25 million. TIPC owns 34% shares. It FSL mainly operates container distribution and logistics warehousing in Surabaya, Indonesia and also provides container consolidation, container maintenance, inland and ocean freight, and third party logistics operations (integrated logistics).

Established on May 17, 2018, with a paid-in capital of NT$ 100 million. TIPC owns 28% shares. In line with the government's offshore wind power policy and the introduction of the Global Wind Organization (GWO) training standards, TIWTC mainly provides localized training services and related basic safety training for the wind power industry, also planning and handling various customized training courses in line with the needs of the industry.

Established on October 10, 2018 with a paid-in capital of USD 10 million. TIPC owns 36% shares. Combined with domestic shipping port and logistics-related operators, the TFI operates local port and logistics-related businesses with industry-related operators through the establishment of a holding company in Singapore.

2020

Established on December 16, 2020, with a paid-in capital of NT$ 10 million. TIPC owns 49% shares. TIPH is located in Taichung Port, and its main business is to provide technical inspection and various customized transportation services for wind power operators. TIPH also specializes in offshore wind power heavy cargo transportation business and provides rescue services and turnkey transportation services.

Introduction to each port

TIPC uses the concept of "port cluster" to promote its overall business development. The Keelung Branch, Taichung Branch, Kaohsiung Branch and Hualien Branch are in charge of seven major international ports, including Port of Keelung, Port of Taipei, Port of Suao, Port of Taichung, Port of Kaohsiung, Port of Anping and Port of Hualien. TIPC manages its international commercial ports including 30,156.5 hectares of water area and 5,988.9 hectares of land area. Additionally, TIPC are entrusted with the operation of two domestic commercial ports, Budai Port and Penghu Port. In 2023, the total number of inbound vessels in the Taiwan ports was 39,653, the cargo throughput was 215,973,393 metric tons, and the cargo handling was 666,328,840 revenue tons. TIPC combines the resources and development characteristics of each port and adopts the strategy of "internal coordination and division of labor, external unification for competition" to deeply cultivate its core business with the concept of entrepreneurial management. The Company will also gradually introduce innovative business operation modes, promote the diversified development of port-related businesses, and study the development positioning of the international commercial port under its jurisdiction. The proposed development positioning will be incorporated into the Taiwan International Commercial Port Future Development and Construction Plan of which will be approved by the Executive Yuan and promoted accordingly, in order to continuously consolidate the competitiveness of Taiwan international commercial port in the maritime transportation market.

Business Performance Major Operating Items

TIPC has continued to work hard in the cargo transportation industry, upgrading various port and providing better services to clients such as carriers, stevedoring, warehousing and logistics related businesses. Meanwhile, through cooperation with the private sectors and relevant government agencies, TIPC are actively developing into a diversified operation mode and expanding the business scope of port operations.

Trends of Major Operating Businesses

- Berthing Services

Affected by the upsizing of vessels, TIPC continues upgrading hard and soft facilities in port and providing high-quality operation environment and efficiency for vessels. - Tugging Services

Through the dispatching method of rolling-wave planning, we revitalize the use of vessels, effectively integrate the harbor duties of each port, strengthen the professional training of ship crews, enhance maritime professional skills, and improve the overall operational efficiency. - Cargo Handling Services

In response to the development of new technology, TIPC continuously upgrades port facilities to enhance safety and efficiency of cargo handling operations. TIPC also introduces incentive schemes to cope with the evolution of shipping alliances aiming to attract port calls and maintain steady growth of cargo volume. - Storage services

To meet the operational needs of the near-port industries, energy development, and operators, we optimize the transportation and storage environment in the port areas. Additionally, we continue to carry out land reclamation projects and construction of related facilities in the logistics and warehousing area to attract operators to move in. - Development Investment

According to the geographic location, development conditions and maturity of Kaohsiung Port and its surrounding areas, the development blueprint of the whole area is drawn up, and the development is planned in phases, so as to recreate a new look of the port area.

Achievement Rate of Main Operating Items

Unit: NT$ thousand

| Main Operating Items | 2022 Financial Statements | 2023 Budget (Target) | 2023 Financial Statements | Target Achievement Rate (%) |

|---|---|---|---|---|

| Berthing Services | 1,549,275 | 1,437,886 | 1,596,282 | 111.02 |

| Tugging Services | 1,757,348 | 1,707,169 | 1,942,544 | 113.79 |

| Cargo Handling Services | 7,336,223 | 7,148,405 | 7,175,656 | 100.38 |

| Storage Services | 732,969 | 636,582 | 767,185 | 120.52 |

| Development Investment | 134,519 | 212,009 | 177,310 | 83.63 |

Equity Investment Items

TIPC's business had extended its scope to logistics, tugboat services, land development, crew training, offshore wind power operation and maintenance, and overseas investment. Additionally, TIPC and the local government are working together to promote waterfront business and recreational development. In line with the government's energy transformation policy, TIPC was offering port facilities to build an offshore wind power industry cluster and an LNG offloading base, aiming to make domestic ports a leading force in the international green energy industry. In 2023, TIPC had recognized NT$ 496 milion in revenue from the equity investments with positive benefits.

Performance of investment in enterprises for 2023

Unit: NT$ thousand

| Items | 2021 | 2022 | 2023 |

|---|---|---|---|

| Share of the profit of subsidiaries and associates | 469,151 | 478,303 | 495,580 |

Overall Financial Performance

Confronted with climate change, the impacts of COVID-19 epidemic and external environment such as the port congestion, TIPC's investment performance continues to grow. In terms of assets activation, the corporate has been actively consulting potential investors in view of favorable land conditions for development and planning for investment that meets market demand. Among which, part of the land of Keelung City Dongnuan New Village Project was leased out for use as a parking lot in 2023, while Lot No. 335-6 in Dade Section of Zhongshan District in Keelung City has been completed investment recruitment. TIPC will continue to negotiate for the remaining lands with potential investors to upraise income from asset utilization. Before that, the lands will be used for temporarily lease. In addition, the development of diversified businesses, such as offshore wind power and waterfront recreation business in line with environmental sustainability and port transformation, has also been successful, which has driven an increase in overall revenue. In 2023, TIPC achieved an overall operating revenue of NT$23.77 billion, and net profit of NT$ 10.96 billion, representing an increase of 0.28% and -3.04% from 2022, respectively.

.png)

Operation Venue

Profit Before Income Tax

The company complies with the provisions of the Income Tax Act, ensuring that its annual income tax returns are audited by an independent certified public accountant. Oversight of these responsibilities rests with the Finance Department.

| The Amount of Income Tax over the Years(Unit: NT$) | |

|---|---|

| 2018 | 1,549,540,300 |

| 2019 | 1,614,382,801 |

| 2020 | 1,499,379,224 |

| 2021 | 1,777,367,658 |

| 2022 | 1,912,380,016 |

| 2023 | 1,842,079,970 |

The disclosure includes income tax payments for 2018 to 2022 and income tax accruals for 2023, based on the audited financial statements.

Financial Data

| Conomic performance over the past 3 years(Unit: NT$ thousand) | |||

|---|---|---|---|

| Item/Year | Year 2021 | Year 2022 | Year 2023 |

| Total revenue (A) | 23,288,938 | 27,883,485 | 28,182,583 |

| Total expenditure (B=B1+B2+B3+B4) | 16,007,936 | 16,576,335 | 17,218,872 |

| Employees' pay (B1) | 3,265,905 | 3,286,069 | 3,319,490 |

| Payments to government (tax and donations) (B2) |

2,117,066 | 2,601,296 | 2,780,042 |

| Community investment (B3) | 3,631 | 3,904 | 7,122 |

| Others (B4) | 10,621,334 | 10,685,066 | 11,112,218 |

| Net profit (A-B) | 7,281,002 | 11,307,150 | 10,963,711 |

| Net profit attributable to: | 7,281,002 | 11,307,150 | 10,963,711 |

| Owners of the parent corporation (a) | 7,279,925 | 11,308,778 | 10,962,145 |

| Non-controlling interests | 1,077 | -1,628 | 1,566 |

| Other comprehensive income transfers and others (b) | 1,821,838 | 3,521,719 | -100,667 |

| Retained earnings available for distribution (C=a+b) | 9,101,763 | 14,830,497 | 10,861,478 |

| Payments to provider of capital (C1) | 3,030,887 | 5,062,895 | 3,616,872 |

| Payments to government (Distribution of retained earnings) (C2) | 3,931,962 | 6,326,243 | 4,692,159 |

| Economic value retained (C3) | 2,138,914 | 3,441,359 | 2,552,447 |

Note:

- The amounts for 2021 and 2022 were audited, which for 2023 were unaudited.

- "Employees' pay (B1)" includes employee's salary, overtime, allowance, bonus, retirement, welfare (including medical check-up expenses), and contribution.

- "Payments to government (B2 and C2)" includes tax, donations to the government and the distribution of retained earnings to government agencies.

- "Community investment (B3)" includes expenditures for social welfare and neighborliness.

- "Direct economic value generated" = Total revenue (A) + other comprehensive income transfers (b) - non-controlling interests.

- Economic value distributed: Total expenditure (B) + payments to provider of capital (C1) + payments to government (distribution of retained earnings) (C2).

- Economic value retained: "Direct economic value generated" minus "economic value distributed".

Government Grants

| Granted projects in 2023 - List of government grants | ||

|---|---|---|

| Project | Granting agency | Amount of grant (NT$) |

| Organized "Forward-looking Infrastructure Development Program - Recreation and Waterfront Project" | General fund special budget approved by Executive Yuan (2021-2025) | 49,000,000 |

| Keelung, Taichung, and Kaohsiung Branch operating fees (Academic Year 2022) - Phase 2 | K-12 Education Administration, Ministry of Education | 360,000 |

| Grant for providing grounds, facilities, and equipment for workplace cooperative educare service centers without reimbursement for Keelung, Taichung, and Kaohsiung Branch (Academic Year 2022) - Phase 2 | 1,530,000 | |

| Keelung, Taichung, and Kaohsiung Branch operating fees (Academic Year 2023) - Phase 1 | 240,000 | |

| Grant for providing grounds, facilities, and equipment for workplace cooperative educare service centers without reimbursement for Keelung, Taichung, and Kaohsiung Branch (Academic Year 2023) - Phase 1 | 540,000 | |

| Subsidy for monitoring of diesel vehicle specific pollutants in Taichung Port Air Quality Maintenance Zone by Environmental Protection Bureau | Environmental Protection Bureau, Taichung City Government | 7,620 |

| Total | 51,677,620 | |

Procurement Statistics

| Type of contract | Purchasing region | 2021 | 2022 | 2023 | |||

|---|---|---|---|---|---|---|---|

| Number | Percentage of total purchase amount |

Number | Percentage of total purchase amount |

Number | Percentage of total purchase amount |

||

| Labor (Contracting and services) |

Domestic | 310 | 99.82% | 378 | 99.95% | 378 | 99.79% |

| Overseas | 2 | 0.18% | 5 | 0.05% | 3 | 0.21% | |

| Properties (Raw materials and equipment) |

Domestic | 98 | 99.93% | 152 | 99.71% | 146 | 100% |

| Overseas | 2 | 0.07% | 2 | 0.29% | 0 | 0% | |

| Projects (Construction and project) |

Domestic | 133 | 100% | 220 | 100% | 253 | 100% |

| Overseas | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total | 545 | 100% | 757 | 100% | 780 | 100% | |

Note:

- Domestic refers to the local area of Taiwan; overseas refers to the area outside of Taiwan.

- Percentage of total purchase amount (Amount in this column)/ (Labor purchase amount+Property purchase amount+Project purchase amount)